Top OEMs for Water & Wastewater Automation Systems

1. Introduction

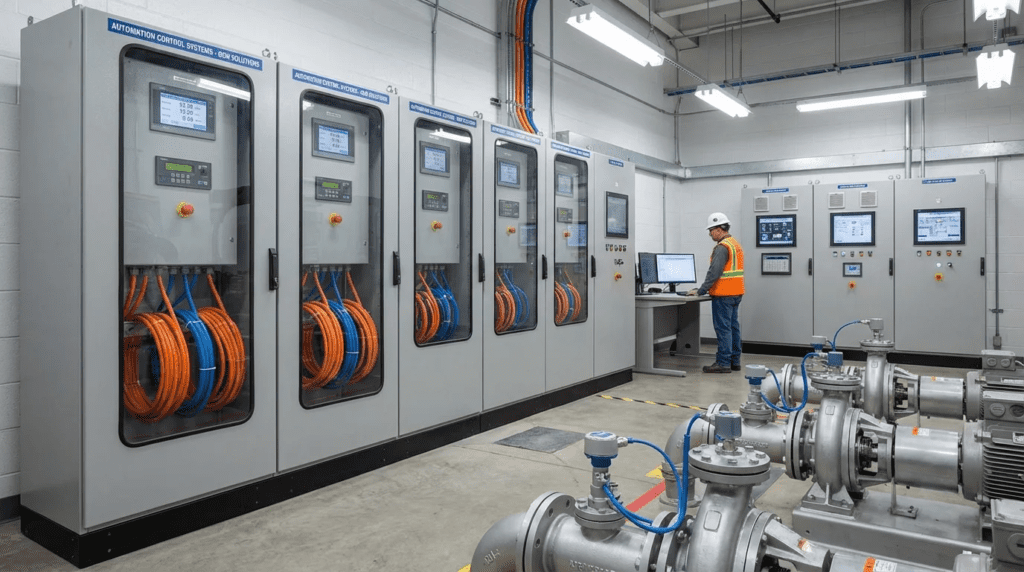

In the municipal water and wastewater sector, the “nervous system” of any treatment facility or distribution network is its automation system. While Programmable Logic Controllers (PLCs) and HMI software provide the raw computing power and visualization, the successful implementation of these technologies relies heavily on the Systems Integrator (SI) or the Automation System OEM. These entities are responsible for the physical design of control panels, the aggregation of instrumentation data, the programming of logic, and the overall system architecture that ensures regulatory compliance and public safety.

For consulting engineers and utility managers, distinguishing between a hardware manufacturer and a complete Automation System OEM is critical. While companies like Rockwell Automation or Siemens manufacture the component level processors, the Automation System OEMs—such as Tesco Controls, Data Flow Systems, and Primex Controls—engineer the complete solution. They design the UL 508A panels, integrate the telemetry (radio, cellular, or fiber), develop the control strategies, and assume responsibility for the “womb-to-tomb” operation of the SCADA (Supervisory Control and Data Acquisition) network.

The operating environment for these systems is harsh and unforgiving. Control panels in lift stations are exposed to corrosive hydrogen sulfide gases, extreme humidity, and wide temperature fluctuations. Plant SCADA systems must process thousands of I/O points with near-zero latency to manage complex biological nutrient removal processes or high-pressure distribution pumping. Furthermore, the regulatory context—driven by the EPA and state agencies—demands rigorous data integrity. An automation system is not merely a control mechanism; it is the legal record of compliance. If the system fails to log turbidity spikes or chlorine residuals due to a communication dropout or processor fault, the utility faces significant fines and public trust issues.

Therefore, selecting the right Automation System OEM is arguably more critical than selecting the hardware brand itself. A poorly integrated system using top-tier hardware will fail, whereas a expertly engineered system using mid-range hardware can provide decades of reliable service. This article analyzes the top Automation System OEMs and Integrators serving the North American water and wastewater market, focusing on their engineering philosophies, system architectures, and long-term supportability.

2. How to Select an Automation System OEM

Selection of a partner for automation infrastructure requires a departure from standard “low bid” procurement mentalities. Automation is professional services combined with custom manufacturing. Engineers must evaluate potential partners based on technical capability, architectural philosophy, and specific experience with hydraulic and biological processes.

Functional Role and System Architecture

The primary decision point in selecting an OEM is the choice between “Open Architecture” and “Turnkey/Proprietary Architecture.”

Open Architecture: This approach utilizes off-the-shelf hardware (e.g., Allen-Bradley, Modicon, Siemens) and standard software (Ignition, Wonderware, VTScada). The Automation OEM acts as a custom engineering firm that assembles these components into a functioning system. The advantage is that the utility is not locked into a single vendor for hardware; however, they rely heavily on the quality of the OEM’s code and documentation. If the OEM leaves, another integrator can theoretically take over, provided the code is not password-protected or obfuscated.

Turnkey/Proprietary Architecture: Some OEMs provide a complete, vertical solution where they manufacture the RTU (Remote Telemetry Unit), the communication equipment, and the SCADA software. The advantage is “single-source responsibility.” There is no finger-pointing between the software vendor and the hardware vendor because they are the same entity. These systems often offer superior backward compatibility and lower licensing fees, but they create a dependency on that specific OEM for the life of the system.

Reliability and Redundancy Strategies

Water and wastewater systems are mission-critical. The selected OEM must demonstrate a robust approach to redundancy. This goes beyond simply having backup power. Engineers should look for:

- Hot-Standby CPUs: Capability to seamlessly switch processors in the event of a hardware failure without process interruption.

- Redundant Communication Paths: The ability to route data via radio primary and cellular backup automatically.

- Store-and-Forward Capability: If the communication link to the central SCADA is lost, the local panel (RTU) must buffer data and upload it once the link is restored to prevent data gaps in regulatory reports.

- Manual Bypass Logic: The control panel design must allow operators to run pumps and valves in “Hand” mode effectively, independent of the PLC/automation logic, using hardwired relays and interlocks for safety.

Panel Construction and Environmental Hardening

The physical quality of the control panel dictates the lifespan of the electronics inside. OEMs must be evaluated on their panel shop standards. A UL 508A (Industrial Control Panels) listing is the bare minimum. For hazardous locations common in wastewater (Class I, Div 1 or 2), a UL 698A listing is required for panels containing intrinsically safe barriers.

Inspect the OEM’s standard specifications for thermal management. Do they use active cooling (A/C) or passive heat exchangers? How do they handle condensation? The layout of the backplane is also telling; wire ducts should not be overstuffed, and high-voltage (480V) components should be physically segregated and shielded from low-voltage (24VDC) signal wiring to prevent electromagnetic interference (EMI) that causes erratic analog readings.

Cybersecurity and Network Design

In the modern threat landscape, the Automation OEM is the first line of defense. The days of air-gapped systems are largely over due to the demand for remote access and data reporting. The OEM must demonstrate competence in IEC 62443 standards.

Key questions for the OEM include: Do they support managed switches with port security? Do their RTUs support encryption? How do they handle remote access for support—is it via secure VPN with multi-factor authentication, or unsecure methods? For proprietary systems, the risk of “zero-day” exploits affecting Windows-based SCADA is often lower, but the proprietary OS must still be vetted for security vulnerabilities.

Lifecycle Cost and Support

The initial capital cost of an automation system is often only 20% of its 15-year lifecycle cost. Software licensing fees (annual support contracts), hardware obsolescence cycles, and the cost of specialized labor to troubleshoot code must be factored in. Open architecture systems often carry high annual software maintenance costs (support) from the major software vendors. Proprietary/Turnkey OEMs often include software updates for free but may charge higher rates for proprietary hardware replacement.

3. Comparison Table

The following table compares the leading Automation System Integrators and OEMs. It highlights their primary architectural approach (Open vs. Proprietary), their typical market sweet spot, and key considerations for engineering specifications. Engineers should use this to align the OEM’s strengths with the specific project requirements (e.g., a massive treatment plant vs. a distributed county-wide lift station network).

| OEM / Integrator | Primary Architecture | Typical Applications | Strengths | Limitations | Lifecycle Considerations |

|---|---|---|---|---|---|

| Tesco Controls | Open (System Integrator & OEM) | Large W/WW Plants, Regional Systems, Complex Logic | Massive scale capacity; deep expertise in major PLC platforms (Rockwell, Siemens); extensive professional engineering staff; CSIA Certified. | Can be overkill for very small, simple systems; reliance on third-party software licensing costs. | High long-term flexibility; standard hardware allows multiple support vendors, but software maintenance fees apply. |

| Data Flow Systems (DFS) | Turnkey / Proprietary | Remote Telemetry, Collection Systems, Water Distribution | Single-source responsibility; no software licensing fees; excellent backward compatibility; specialized “Hyper-SCADA” server. | Hardware lock-in (proprietary RTUs); less suited for plants requiring specific PLC brands (e.g., if a spec mandates Allen-Bradley). | Very low O&M software costs; hardware support dependent on DFS longevity (which is historically strong). |

| Dorsett Technologies | Turnkey / Proprietary | Municipal SCADA, Smart Water Grids | Integrated InfoScan SCADA software; intelligent RTUs; strong focus on enterprise-wide data visibility and energy management. | Proprietary ecosystem limits ability to bid out hardware replacements to third parties. | Simplifies vendor management; typically lower recurring software costs than open platforms. |

| Advanced Integration & Controls | Open (System Integrator) | Mid-to-Large W/WW, Retrofits | High customization; strong capability in retrofitting legacy systems; agnostic to hardware brands. | As a pure integrator, reliant on third-party hardware lead times and support structures. | Standard industry components ensure parts availability; reliance on quality of initial programming. |

| Primex Controls | Open / Hybrid OEM | Lift Stations, Pump Control, Municipal Water | “Pump Watch” cloud solutions; huge volume manufacturing of pump panels; Arc Armor safety systems; highly standardized designs. | Standardized solutions may require adaptation for highly non-standard, complex process control applications. | Excellent for fleet management of pump stations; cloud-based options shift costs to OpEx. |

| Control Assemblies | Open (System Integrator) | Industrial WW, Municipal Plants | Strong custom panel fabrication; bridge between industrial process and municipal requirements; robust electrical engineering. | Less focus on proprietary telemetry products compared to DFS or Dorsett; focuses on panel build and integration. | High-quality panel construction extends physical asset life; standard PLC components used. |

4. Top OEMs / System Integrators

Tesco Controls

Overview: Tesco Controls is one of the largest and most established system integrators in the North American water sector. Based in California but operating nationally, Tesco operates as a hybrid: they are a massive custom job shop and an Original Equipment Manufacturer of control systems. They are particularly dominant in the western United States but have a significant footprint in major metropolitan infrastructure projects across the country.

Engineering Approach: Tesco is primarily known for “Open Architecture” implementation. They are top-tier partners with major hardware vendors like Rockwell Automation, Siemens, and Schneider Electric. However, unlike smaller integrators, Tesco has the capacity to manufacture its own sub-components and perform large-scale UL panel assembly in-house. Their engineering approach relies heavily on professional engineering (PE) oversight, making them a preferred choice for complex treatment plants where hydraulic modeling and intricate PID loop tuning are required.

Technical Differentiators:

One of Tesco’s core strengths is its capability to handle “Main Plant” SCADA modernization. They are adept at managing projects with 50,000+ tags and redundant server farms. They also offer their own line of power distribution equipment and can integrate Motor Control Centers (MCCs) directly with the automation logic, reducing interface risks between the electrical and instrumentation trades.

Best Application: Large-scale water treatment plants, complex wastewater reclamation facilities, and regional water transmission systems where adherence to strict engineering specifications and CSI Division 13/17 standards is mandatory.

Data Flow Systems (DFS)

Overview: Data Flow Systems, based in Florida, represents the “Turnkey” or “Single Source” philosophy. For over 40 years, DFS has manufactured its own RTUs (Remote Telemetry Units) and developed its own SCADA software (HT3/Hyper-SCADA). They challenge the industry norm of mixing and matching hardware and software from different vendors, arguing that a unified ecosystem provides higher reliability and accountability.

Engineering Approach: The DFS philosophy centers on the “TCT” (Telemetry Control Terminal) and the avoidance of Windows-based vulnerabilities at the server level (using Linux/Unix derivatives for core stability). Their architecture is designed specifically for the narrow bandwidth and high latency challenges of radio telemetry in water distribution and wastewater collection systems. Because they manufacture the RTU circuit boards and write the server software, they guarantee communication drivers and protocols work seamlessly without the “driver conflict” issues common in open systems.

Technical Differentiators:

DFS offers a “perpetual software license” model, meaning utilities do not pay annual “support” or “tag count” fees for the SCADA software, which is a significant lifecycle cost advantage. Their RTUs are backward compatible for decades; a new CPU card can often fit into a 20-year-old backplane. They also specialize in complex radio path studies and narrow-band telemetry.

Best Application: Sprawling county-wide collection systems, rural water districts, and utilities frustrated with the “IT treadmill” of constant Windows patching and software licensing fees.

Dorsett Technologies

Overview: Dorsett Technologies is a prominent player in the municipal controls market, particularly in the Southeast and South-Central US. Like DFS, they offer a vertically integrated solution, manufacturing their own intelligent SCADA hardware and software under the InfoScan brand. They have evolved to focus heavily on “Smart Water” concepts, integrating typical SCADA control with enterprise-level data analytics.

Engineering Approach: Dorsett’s architecture is built around intelligent distributed control. Their controllers (Moklume) are designed to handle local logic autonomously while communicating with a centralized enterprise server. Their engineering focuses on ease of use for the operator, often presenting complex data in intuitive dashboards. They place a strong emphasis on energy management, helping utilities monitor pump efficiency and energy consumption alongside standard process variables.

Technical Differentiators:

Dorsett stands out for its integrated approach to HVAC and process control. While many integrators separate building management from process control, Dorsett often unifies these, which is beneficial for plant environments. Their systems are known for robust lightning protection and environmental hardening, catering to the severe weather conditions of their primary geographic markets.

Best Application: Mid-to-large municipalities looking for a unified hardware/software solution that incorporates energy management and business intelligence into the standard SCADA interface.

Advanced Integration & Controls (AIC)

Overview: Advanced Integration & Controls operates as a high-level system integrator, focusing on providing customized, non-proprietary solutions. They position themselves as the “engineer’s integrator,” capable of executing highly specific sequence of operations without trying to force the utility into a proprietary product line.

Engineering Approach: AIC excels in the “Open Architecture” domain. Their engineers are typically cross-trained on multiple platforms (Rockwell, GE, Siemens, VTScada, Ignition). Their value proposition is flexibility. If a utility has an existing mix of PLC-5s, ControlLogix, and Modicon Quantum, AIC specializes in bridging these legacy systems or migrating them to a modern standard without total “rip and replace” disruption.

Technical Differentiators:

AIC is noted for its strength in retrofit projects. Designing a greenfield SCADA system is straightforward; keeping a 30-year-old plant running while hot-swapping the control brain is difficult. AIC has developed methodologies for parallel operation and phased migration that minimize risk during switchovers.

Best Application: Retrofit projects, utilities with diverse hardware standards, and industrial wastewater treatment facilities requiring custom integration with plant production systems.

Primex Controls

Overview: Primex Controls is a powerhouse in the water market, specifically for lift stations and pump control panels. While they handle plant SCADA, their ubiquity comes from their standardized pump control solutions. Owned by SJE, Primex leverages massive manufacturing capabilities to deliver high volumes of UL-listed control panels.

Engineering Approach: Primex utilizes a “configured standard” approach. While they build custom panels, they have heavily productized their offering (e.g., the Station View controller). This allows for rapid deployment and consistent operator experience across hundreds of lift stations. They have been early adopters of cloud-based SCADA (IcSCADA), allowing smaller utilities to bypass the cost of maintaining local servers.

Technical Differentiators:

The “Arc Armor” enclosure is a significant safety innovation promoted by Primex. This multi-compartment control panel segregates the user interface and low-voltage controls from the high-voltage power section, allowing operators to check status or reset systems without suiting up in full Arc Flash Personal Protective Equipment (PPE). This directly addresses maintenance safety and compliance.

Best Application: Lift station fleets, stormwater pumping stations, and small-to-medium utilities seeking cloud-based monitoring solutions without heavy IT infrastructure investment.

Control Assemblies

Overview: Control Assemblies brings a strong industrial pedigree to the municipal market. With decades of experience in process automation (food and bev, grain, industrial), they apply rigorous industrial standards to water and wastewater projects. They are a custom panel shop and integrator that focuses on robust electrical design.

Engineering Approach: Their approach is highly specification-driven. Control Assemblies is known for detailed shop drawings and high-quality fabrication. They do not typically push a proprietary software product; rather, they are experts at implementing Rockwell, Siemens, or Schneider specifications exactly as the consulting engineer intends. Their industrial background means they are often more comfortable with complex motion control, VFD integration, and high-speed data acquisition than typical municipal integrators.

Technical Differentiators:

Fabrication quality. Control Assemblies panels often feature higher-grade wiring management, labeling, and component spacing derived from industrial standards. They are excellent at integrating complex vendor packages (e.g., centrifuge control panels, blower packages) into the main plant SCADA.

Best Application: Industrial wastewater pretreatment plants, mixed-use facilities, and municipal plants where high-quality custom panel fabrication is the priority over proprietary software solutions.

5. Application Fit Guidance

Selecting the right partner from the list above requires matching the OEM’s DNA to the project’s specific needs. Here is a breakdown of best-fit scenarios:

Complex Treatment Plants (Greenfield or Major Rehab)

For large facilities with complex biological processes (MBR, IFAS), chemical pacing, and extensive redundancy requirements, Tesco Controls and Advanced Integration & Controls (AIC) are the primary contenders. These projects require deep knowledge of PLC tag structures, complex PID loops, and the ability to manage thousands of I/O points. The open architecture approach is essential here to ensure the plant can be supported by multiple vendors in the future.

Distributed Collection and Distribution Systems

For utilities managing hundreds of remote lift stations or water towers spread across a county, Data Flow Systems (DFS) and Dorsett Technologies offer significant advantages. Their proprietary telemetry protocols are often more robust over difficult radio terrain than standard Modbus/TCP polling over radio. The “single source” nature of their offering simplifies the maintenance of a sprawling network.

High-Volume Lift Station Fleets

When a utility needs to standardize controls across 50 to 200 lift stations to simplify spare parts and operator training, Primex Controls is the logical fit. Their productized pump controllers and Arc Armor panels provide a repeatable, safe, and reliable solution that reduces the engineering burden for each individual site.

Industrial and Custom Retrofits

For industrial wastewater plants or municipal projects requiring integration of unusual equipment (e.g., foreign OEM skid-mounted systems), Control Assemblies and AIC provide the necessary custom engineering flexibility. They are less bound by rigid product lines and can adapt to the constraints of existing electrical rooms and legacy conduit schedules.

6. Engineer & Operator Considerations

Regardless of the OEM selected, the success of the automation project relies on execution. Engineers and operators must prioritize the following during the design and construction phase.

The Submittal Process

The shop drawing submittal is the most critical checkpoint in the project. Engineers must demand:

- Complete Bill of Materials (BOM): With exact part numbers to verify long-term availability.

- Loop Drawings: Detailed wiring diagrams for every single instrument loop, showing the path from the field device through the terminal blocks to the PLC card.

- I/O Lists: A verified list of every input and output, including signal type (4-20mA, 24VDC), scale, and tag name.

- HMI Screenshots: Static mockups of the SCADA screens must be reviewed *before* coding begins. This allows operators to give input on color schemes, navigation, and alarm visibility.

Factory Acceptance Testing (FAT)

Never ship a control panel to the site without a FAT. The consulting engineer and the plant representative should visit the OEM’s shop. The panel should be powered up, and I/O should be simulated using signal generators. The logic should be tested against the Control Narrative. Finding a bug in the shop costs $100; finding it in the field during startup costs $10,000 and risks permit violations.

Spare Parts and Obsolescence

Electronic components age faster than concrete tanks. When specifying a system, require the OEM to provide a guaranteed support path for at least 10 years. For Open Architecture systems (Tesco, AIC, Primex, Control Assemblies), this is dictated by the hardware manufacturer (e.g., Rockwell). For Proprietary systems (DFS, Dorsett), written guarantees of backward compatibility are essential. Utilities should stock critical spares: a CPU, a power supply, and one of each I/O card type.

Cybersecurity Commissioning

Commissioning is no longer just about checking pump rotation. It must include a cybersecurity audit. The OEM should deliver the system with default passwords changed, unnecessary ports closed, and unused services disabled. Network segmentation (VLANs) should be verified to ensure the SCADA network is isolated from the business office network.

7. Conclusion

The selection of an Automation System OEM defines the operability of a water or wastewater utility for a generation. It is a choice between philosophies as much as a choice between companies.

For utilities prioritizing total control over hardware selection and open standards, integrators like Tesco Controls, Advanced Integration & Controls, and Control Assemblies offer the flexibility and scale required for modern plant operations. For utilities seeking a unified, single-source solution to minimize IT overhead and manage distributed assets, Data Flow Systems and Dorsett Technologies provide compelling, robust ecosystems. For those managing vast fleets of pumping stations, Primex Controls delivers safety and standardization.

Engineers must look beyond the initial bid price. The “low bid” integrator often delivers “spaghetti code” and messy wiring that plagues the maintenance staff for decades. By specifying qualified OEMs with proven track records in the water sector, and by rigorously enforcing design and testing standards, utilities can ensure their automation systems remain silent, reliable guardians of public health.