Introduction: The State of Kansas Water Infrastructure

Kansas presents a unique dichotomy in wastewater infrastructure, characterized by sophisticated, high-capacity biological nutrient removal (BNR) facilities in the rapid-growth corridors of Johnson County and Wichita, contrasted with hundreds of lagoon systems serving rural communities. For municipal consulting engineers and utility managers, the Kansas market is currently defined by a massive shift toward nutrient reduction compliance and capacity expansion to support industrial growth, particularly in the “Battery Belt” near De Soto.

Overseen by the Kansas Department of Health and Environment (KDHE), the state manages over 800 permitted wastewater facilities. The primary regulatory driver in the current cycle is the Kansas Nutrient Reduction Strategy, pushing mechanical plants toward stringent Nitrogen and Phosphorus limits to protect sensitive receiving waters like the Kansas and Arkansas Rivers. Currently, the state boasts a total treatment capacity exceeding 450 MGD (Million Gallons per Day), serving a population of approximately 2.9 million.

With the influx of Infrastructure Investment and Jobs Act (IIJA) funding and aggressive State Revolving Fund (SRF) management, Kansas is witnessing a capital improvement boom, particularly in advanced treatment technologies including Membrane Bioreactors (MBR) and water reuse initiatives for aquifer sustainability.

Recent Developments & Projects

The Kansas wastewater sector has seen over $800 million in capital deployment over the last 36 months. The dominant trend is the retrofit of aging trickling filter and conventional activated sludge plants into advanced BNR facilities.

Key developments include:

- The Johnson County Wastewater (JCW) Expansion: JCW has executed one of the largest infrastructure programs in the Midwest, recently completing the Tomahawk Creek facility—one of the largest MBR installations in North America—and currently upgrading the Nelson Complex.

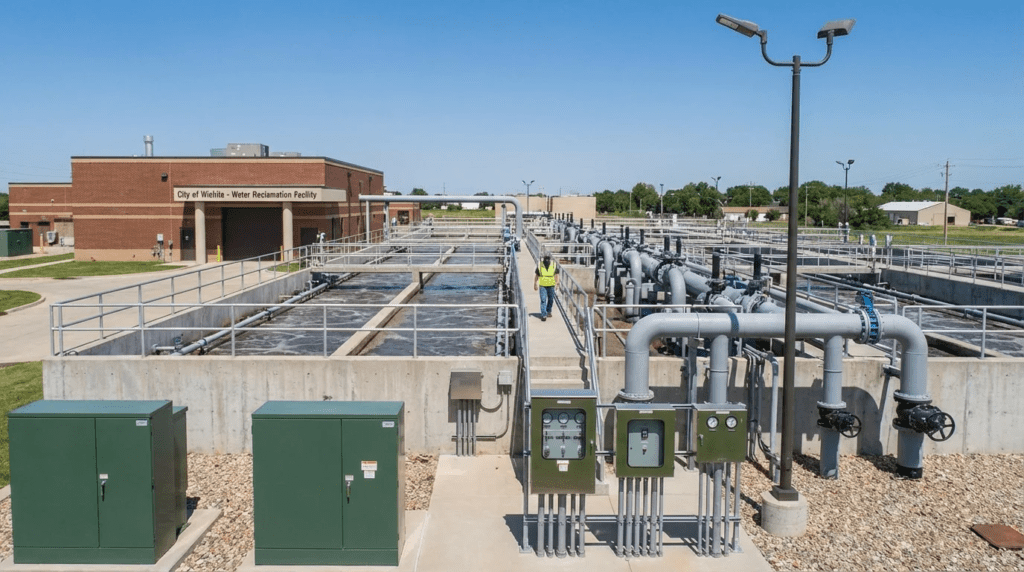

- Wichita’s Biological Nutrient Removal Program: Driven by regulatory mandates, the City of Wichita is investing heavily to modify its plants for enhanced nutrient removal to protect the Arkansas River.

- Panasonic Energy Impact: The massive EV battery plant construction in De Soto has triggered immediate, large-scale water and wastewater infrastructure expansion needs to support the industrial load and associated housing growth.

- Water Reuse Initiatives: Western Kansas communities, facing Ogallala Aquifer depletion, are pioneering direct non-potable reuse for agricultural and industrial applications, blending wastewater engineering with water resource management.

Top 20 Largest Wastewater Treatment Plants in Kansas

The following list ranks the largest wastewater treatment facilities in Kansas by design capacity. This data is compiled from KDHE permits, municipal CIPs, and direct utility reporting.

| Rank | Plant Name | City/Location | Design Capacity (MGD) | Population Served | Operating Authority |

|---|---|---|---|---|---|

| 1 | Lower Arkansas WWTF (Plant 2) | Wichita | 54.0 MGD | ~390,000 | City of Wichita |

| 2 | Nelson Complex | Mission | 26.5 MGD | ~180,000 | Johnson County Wastewater |

| 3 | Tomahawk Creek WWTF | Leawood | 19.0 MGD | ~150,000 | Johnson County Wastewater |

| 4 | Oakland WWTF | Topeka | 16.0 MGD | ~90,000 | City of Topeka |

| 5 | Kansas River WWTF | Lawrence | 12.5 MGD | ~75,000 | City of Lawrence |

| 6 | Cedar Creek WWTF | Olathe | 11.5 MGD | ~70,000 | City of Olathe |

| 7 | Blue River Main (KS Flow) | Overland Park | 11.0 MGD | ~60,000 | Johnson County Wastewater |

| 8 | Manhattan WWTF | Manhattan | 11.0 MGD | ~55,000 | City of Manhattan |

| 9 | North Topeka WWTF | Topeka | 10.0 MGD | ~35,000 | City of Topeka |

| 10 | Salina WWTF | Salina | 7.5 MGD | ~46,000 | City of Salina |

| 11 | Hutchinson WWTF | Hutchinson | 6.7 MGD | ~40,000 | City of Hutchinson |

| 12 | Wakarusa River WWTF | Lawrence | 6.0 MGD | ~25,000 | City of Lawrence |

| 13 | Four Mile Creek (Plant 1) | Wichita | 6.0 MGD | ~30,000 | City of Wichita |

| 14 | Harold Street WWTF | Olathe | 5.5 MGD | ~35,000 | City of Olathe |

| 15 | Leavenworth WWTF | Leavenworth | 5.3 MGD | ~36,000 | City of Leavenworth |

| 16 | Garden City WWTF | Garden City | 5.0 MGD | ~26,000 | City of Garden City |

| 17 | Emporia WWTF | Emporia | 4.5 MGD | ~24,000 | City of Emporia |

| 18 | Dodge City South WWTF | Dodge City | 4.2 MGD | ~27,000 | City of Dodge City |

| 19 | Middle Basin WWTF | Leawood | 4.0 MGD | ~20,000 | Johnson County Wastewater |

| 20 | Junction City West | Junction City | 3.5 MGD | ~22,000 | City of Junction City |

Detailed Profiles of the Top 5 Largest Plants

1. Lower Arkansas Wastewater Treatment Facility (Plant 2)

- Location: Wichita, Sedgwick County, KS

- Design Capacity: 54.0 MGD (Peak Wet Weather >100 MGD)

- Population Served: ~390,000 residents

- Operating Authority: City of Wichita Public Works

- Receiving Water: Arkansas River

Treatment Process: The plant utilizes preliminary screening and grit removal, primary clarification, and a specialized biological nutrient removal (BNR) activated sludge process. Secondary clarification is followed by UV disinfection before discharge.

Infrastructure Highlights:

– Biosolids: Anaerobic digestion with beneficial land application.

– Energy: Co-generation facilities utilize biogas to offset electrical demand.

Recent Upgrades: The facility is currently undergoing the massive “BNR Improvements Project” (detailed in Section 4) to meet strict NPDES permits regarding nitrogen and phosphorus limits.

2. Nelson Complex (Mission Main)

- Location: Mission, Johnson County, KS

- Design Capacity: 26.5 MGD (Wet Weather Peak 86 MGD)

- Population Served: ~180,000 residents

- Operating Authority: Johnson County Wastewater (JCW)

- Receiving Water: Turkey Creek

Treatment Process: Conventional activated sludge transitioning to BNR. The complex handles flows from the Turkey Creek and Mill Creek basins. It utilizes trickling filters alongside activated sludge, though current upgrades are modernizing this approach.

Infrastructure Highlights:

– Odor Control: Extensive biotowers and chemical scrubbers due to proximity to residential zones.

– Solids: Centralized solids processing for multiple JCW facilities.

Compliance: Operating under a stringent Consent Order to eliminate wet weather overflows, driving significant investment in peak flow management.

3. Tomahawk Creek Wastewater Treatment Facility

- Location: Leawood, Johnson County, KS

- Design Capacity: 19.0 MGD (Peak 172 MGD)

- Population Served: ~150,000 residents

- Operating Authority: Johnson County Wastewater (JCW)

- Receiving Water: Blue River

Treatment Process: One of the world’s largest Membrane Bioreactor (MBR) facilities. Features coarse and fine screening, biological nutrient removal basins, GE/Suez membrane cassettes, and UV disinfection.

Infrastructure Highlights:

– Technology: MBR technology allows for a smaller footprint and produces reuse-quality effluent.

– Peak Flow: Highly sophisticated wet weather storage and treatment train capable of handling massive surges.

Notable Features: The recent $335 million expansion (completed 2022) replaced a joint facility with Kansas City, MO, giving JCW full autonomy. It is a flagship project for Black & Veatch and McCarthy Building Companies.

4. Oakland Wastewater Treatment Plant

- Location: Topeka, Shawnee County, KS

- Design Capacity: 16.0 MGD

- Population Served: ~90,000 residents

- Operating Authority: City of Topeka Utilities

- Receiving Water: Kansas River

Treatment Process: Utilizes an Integrated Fixed-Film Activated Sludge (IFAS) system to enhance nitrogen removal within existing tank volumes. Primary clarification and UV disinfection complete the train.

Compliance: The plant has been optimized to reduce nutrient loading to the Kansas River, a critical concern for downstream users (like Lawrence and WaterOne).

5. Kansas River Wastewater Treatment Plant

- Location: Lawrence, Douglas County, KS

- Design Capacity: 12.5 MGD (Peak 40 MGD)

- Population Served: ~75,000 residents

- Operating Authority: City of Lawrence Municipal Services

- Receiving Water: Kansas River

Treatment Process: Activated sludge process with recent modifications for biological nutrient removal. The facility handles the majority of the University of Kansas load.

Recent Upgrades: The 2018-2020 Nutrient Removal Improvements project added deep-bed denitrification filters and converted existing basins to A2/O processes.

Condensed Listings (Rank 6-20)

Large Regional Plants (Rank 6-10)

- Cedar Creek WWTF (Olathe): 11.5 MGD. Completed a major Phase 2 expansion in 2019 using vertical loop reactors.

- Blue River Main (JCW): 11.0 MGD. JCW flow component treated at the KCMO Blue River plant; critical inter-local agreement facility.

- Manhattan WWTF: 11.0 MGD. Recently upgraded mechanical solids dewatering to replace drying beds; serves Kansas State University.

- North Topeka WWTF: 10.0 MGD. Secondary plant serving northern Shawnee County; utilizes trickling filter/solids contact process.

- Salina WWTF: 7.5 MGD. Currently in planning for major upgrades to address sulfate limits and aging infrastructure.

Major Municipal Plants (Rank 11-15)

- Hutchinson WWTF: 6.7 MGD. Operates an innovative groundwater remediation interaction; serves major industrial salt/ethanol sector.

- Wakarusa River WWTF (Lawrence): 6.0 MGD. Newest major plant in the region (commissioned 2018) to handle western expansion.

- Four Mile Creek (Wichita): 6.0 MGD. Serves rapidly growing eastern Wichita suburbs; scheduled for BNR retrofits.

- Harold Street WWTF (Olathe): 5.5 MGD. Older facility currently undergoing optimization; focused on odor control and peak flows.

- Leavenworth WWTF: 5.3 MGD. Located near Ft. Leavenworth; critical upgrades planned for influent pump station.

Plants with Approved Budgets & Expansion Projects

Kansas utilizes a robust mix of State Revolving Funds (SRF), WIFIA loans, and local revenue bonds to fund infrastructure. Below is a breakdown of the most significant active capital projects.

A. Major Projects Under Construction (2024-2026)

Wichita Biological Nutrient Removal (BNR) Improvements – $350+ Million

- Location: Wichita, KS (Plants 1 & 2)

- Project Scope: Comprehensive retrofit of both major treatment plants to achieve biological nitrogen and phosphorus removal. Includes new aeration basins, blowers, and solids handling improvements.

- Total Budget: Est. $357 Million

- Funding Breakdown:

- 95% WIFIA Loan (EPA)

- 5% Local Revenue Bonds

- Timeline: Construction started late 2023; Completion expected 2027.

- Key Contractors:

- Design Engineer: Burns & McDonnell

- Construction Manager at Risk (CMAR): Garney Construction

- Drivers: Compliance with new KDHE nutrient reduction requirements and aging asset replacement.

Nelson Complex Improvements (Phase 1 & 2) – $280 Million

- Location: Mission, KS

- Project Scope: Replacement of aging trickling filters with activated sludge, hydraulic peak flow management improvements to 86 MGD, and new headworks.

- Total Budget: $280 Million (Phased)

- Funding Breakdown:

- Kansas SRF Loans

- JCW Revenue Bonds

- Timeline: Phase 1 active; Phase 2 Design ongoing through 2025.

- Key Contractors:

- Design Engineer: HDR / Black & Veatch

- General Contractor: McCarthy Building Companies

- Drivers: Wet weather overflow reduction (Consent Order) and asset renewal.

De Soto Water/Wastewater Expansion (Panasonic Project) – $50 Million

- Location: De Soto, KS

- Project Scope: Expansion of treatment capacity and conveyance to support the new Panasonic EV battery manufacturing facility.

- Funding: State grants, KDOT economic development funds, local match.

- Timeline: Fast-tracked for 2024-2025 completion.

- Drivers: Massive industrial economic development.

B. Projects in Design/Planning Phase (2025-2027)

- Salina WWTF Improvements:

Budget: ~$25 Million

Scope: Headworks replacement and grit removal upgrades. Currently in SRF planning stage. - Manhattan Northside Expansion:

Budget: ~$15 Million

Scope: Capacity expansion to accommodate growth in the NBAF (National Bio and Agro-Defense Facility) corridor. - Olathe Cedar Creek Phase 3:

Budget: TBD

Scope: Future planning for ultimate buildout capacity as western Olathe fills in.

C. Recently Completed Major Projects (2022-2024)

- Tomahawk Creek WWTF (Johnson County): Completed 2022. $335 Million. Converted a conventional plant to a 19 MGD MBR facility. Award-winning project for collaborative delivery.

- Lawrence Nutrient Removal Project: Completed 2022. $65 Million. Successfully reduced effluent Nitrogen and Phosphorus to meet KDHE goals.

Summary Statistics

- Total Active Capital Investment: ~$680 Million currently active.

- Primary Project Drivers: Nutrient Compliance (60%), Wet Weather/Capacity (30%), Industrial Support (10%).

- Funding Sources: WIFIA and SRF loans dominate the landscape due to favorable interest rates compared to traditional municipal bonds.

- Technology Trend: A definitive move away from trickling filters toward Activated Sludge, BNR, and MBR technologies.

Regulatory & Compliance Landscape

The regulatory environment in Kansas is managed by the Kansas Department of Health and Environment (KDHE) Bureau of Water.

Key Regulations Affecting Engineering Decisions:

- Kansas Nutrient Reduction Strategy: This is the single biggest driver of capital costs. Major mechanical plants are now receiving NPDES permits with scheduled compliance dates for total nitrogen (TN) and total phosphorus (TP) limits. This forces upgrades to BNR processes.

- Harmful Algal Blooms (HABs): High-profile algal blooms in reservoirs like Milford Lake have accelerated political will to enforce phosphorus limits on upstream dischargers.

- PFAS Monitoring: While strict limits are still evolving, KDHE is conducting statewide inventory and sampling. Engineers should anticipate future PFAS destruction or removal requirements in upcoming design cycles.

- Biosolids Management: Kansas generally supports beneficial reuse (land application) of Class B biosolids, but increasing regulations on vector attraction reduction are pushing utilities toward better digestion or thermal drying technologies.

Infrastructure Challenges & Opportunities

The Rural/Urban Divide: Kansas faces a distinct split. Urban centers (KC Metro, Wichita, Topeka) have the tax base to fund massive advanced treatment plants. Conversely, rural Kansas relies on hundreds of facultative lagoons. The challenge for engineers is providing cost-effective upgrades (like SAGR systems or Lemna covers) to small lagoons to meet new nutrient limits without bankrupting small towns.

Workforce Shortage: There is a critical shortage of Class III and IV certified operators. This is driving a trend toward SCADA automation and remote monitoring technologies in new plant designs to reduce the manual labor burden.

Water Reuse Opportunities: In Western Kansas, where the Ogallala Aquifer is declining, wastewater is increasingly viewed as a resource. Projects involving effluent reuse for crop irrigation and industrial cooling are high-priority opportunities for engineering firms.

Technology Trends in Kansas

Based on recent bid tabs and project awards, the following technologies are trending in the Kansas market:

- Membrane Bioreactors (MBR): Validated by the success of the Tomahawk Creek plant, MBR is now the standard for footprint-constrained sites requiring high-quality effluent.

- UV Disinfection: Nearly universal replacement of chlorine gas systems to improve safety and reduce chemical byproducts.

- Integrated Fixed-Film Activated Sludge (IFAS): Being used to retrofit existing aeration basins to increase biomass and treatment capacity without building new concrete tanks.

- Thermal Hydrolysis: Being explored by larger utilities to improve anaerobic digestion efficiency and reduce biosolids volume.

Resources for Engineers & Operators

- Kansas Water Environment Association (KWEA) – The state’s primary professional organization, hosting an annual conference vital for networking.

- KDHE Bureau of Water – Access to NPDES permits, SRF funding applications, and regulatory guidance.

- Kansas Municipal Utilities (KMU) – Provides training and advocacy for city-owned utilities.

- Kansas Operator Certification – Information on testing and renewal for Class I-IV wastewater operators.

Frequently Asked Questions

- What is the largest wastewater treatment plant in Kansas?

- The Lower Arkansas Wastewater Treatment Facility (Plant 2) in Wichita is the largest, with a design capacity of 54 MGD and peak flow capabilities exceeding 100 MGD.

- How many permitted wastewater facilities are in Kansas?

- There are over 800 permitted facilities. The majority are small non-discharging or discharging lagoons, with approximately 60-80 major mechanical treatment plants.

- What is the “Tomahawk Creek” project?

- It was a $335 million project by Johnson County Wastewater, completed in 2022, that converted a conventional plant into one of the largest Membrane Bioreactor (MBR) facilities in North America.

- Are Kansas plants required to remove Nitrogen and Phosphorus?

- Yes. The Kansas Nutrient Reduction Strategy is progressively adding N and P limits to NPDES permits, forcing most major mechanical plants to upgrade to Biological Nutrient Removal (BNR) technologies.

- What funding is available for WWTP upgrades in Kansas?

- The primary source is the Kansas Water Pollution Control Revolving Fund (SRF), managed by KDHE. Recently, large utilities like Wichita have also successfully utilized federal WIFIA loans.

- Who operates the wastewater plants in Johnson County?

- Johnson County Wastewater (JCW) is a separate utility department under the County Board of Commissioners, operating independently of the individual cities (like Overland Park or Leawood) within the county.

- How is the Panasonic battery plant affecting Kansas water infrastructure?

- The massive development in De Soto has triggered expedited projects to expand water and wastewater conveyance and treatment capacity to handle the new industrial load and expected population surge.