Virginia Wastewater Treatment Plants

Introduction

Virginia’s wastewater infrastructure represents some of the most advanced treatment technology in the United States, driven largely by the stringent nutrient reduction mandates of the Chesapeake Bay Preservation Act. With a growing population of over 8.7 million and a geography ranging from the tidal coastal plains to the mountainous Blue Ridge, the state’s engineering challenges are diverse.

The Commonwealth operates under the oversight of the Virginia Department of Environmental Quality (VADEQ). The defining characteristic of the sector in Virginia is the aggressive pursuit of Nitrogen and Phosphorus removal to protect the Chesapeake Bay watershed. This has necessitated the widespread adoption of Biological Nutrient Removal (BNR) and Enhanced Nutrient Removal (ENR) technologies across the state’s estimated 150+ major municipal discharge permit holders.

Currently, the state manages a total treatment capacity exceeding 600 MGD (Million Gallons per Day) across its major municipal facilities. The sector is currently undergoing a massive shift toward water reuse, spearheaded by the Hampton Roads Sanitation District’s (HRSD) SWIFT program and significant wet weather management programs in Richmond and Alexandria.

Recent Developments & Market Outlook

In the last 24 months, Virginia has seen a surge in capital improvement projects driven by three primary factors: climate resilience/wet weather management, aquifer recharge, and aging infrastructure replacement.

The most significant development is the Sustainable Water Initiative for Tomorrow (SWIFT) managed by HRSD. This multi-billion-dollar initiative is converting wastewater to drinking water quality for injection into the Potomac Aquifer to combat land subsidence and saltwater intrusion. This positions Virginia as a global leader in indirect potable reuse (IPR) and advanced water treatment.

Simultaneously, the state is heavily leveraging federal funds. The Virginia Department of Health and VADEQ have mobilized substantial funding from the Infrastructure Investment and Jobs Act (IIJA) and American Rescue Plan Act (ARPA) to address rural sewer needs and urban Combined Sewer Overflow (CSO) abatement. Legislative deadlines set by the Virginia General Assembly have accelerated CSO remediation timelines for Alexandria (2025) and Richmond (2035), catalyzing nearly $1.5 billion in tunneling and plant expansion work.

Top 20 Largest Wastewater Treatment Plants in Virginia

The following ranking is based on permitted design capacity (MGD). Note: While the Blue Plains Advanced Wastewater Treatment Plant treats a significant volume of Northern Virginia’s wastewater, it is located in the District of Columbia and is excluded from this Virginia-sited list.

| Rank | Plant Name | City/Location | Design Capacity (MGD) | Population Served | Operating Authority |

|---|---|---|---|---|---|

| 1 | Noman M. Cole, Jr. Pollution Control Plant | Lorton | 67.0 | ~1.1 million | Fairfax County |

| 2 | Richmond WWTP (R. Byrd) | Richmond | 45.0 (70 Wet) | ~230,000 | City of Richmond (DPU) |

| 3 | Upper Occoquan Service Authority (UOSA) | Centreville | 54.0 | ~350,000 | UOSA |

| 4 | AlexRenew Water Resource Recovery Facility | Alexandria | 54.0 | ~300,000 | Alexandria Renew Enterprises |

| 5 | Nansemond Treatment Plant | Suffolk | 30.0 | Regional | HRSD |

| 6 | Virginia Initiative Plant | Norfolk | 40.0 | Regional | HRSD |

| 7 | Arlington Water Pollution Control Plant | Arlington | 40.0 | ~240,000 | Arlington County |

| 8 | Atlantic Treatment Plant | Virginia Beach | 54.0 | Regional | HRSD |

| 9 | Hopewell Regional Wastewater Treatment Facility | Hopewell | 50.0 | ~130,000 | Virginia American Water |

| 10 | Army Base Treatment Plant | Norfolk | 18.0 | Regional | HRSD |

| 11 | Moores Creek AWRRF | Charlottesville | 15.0 | ~110,000 | Rivanna Water & Sewer Authority |

| 12 | Roanoke Regional WPCP | Roanoke | 55.0 (Peak) | ~250,000 | Western Virginia Water Authority |

| 13 | Broad Run Water Reclamation Facility | Ashburn | 11.0 | Growing | Loudoun Water |

| 14 | Boat Harbor Treatment Plant | Newport News | 25.0 | Regional | HRSD |

| 15 | Chesapeake-Elizabeth Treatment Plant | Virginia Beach | 24.0 | Regional | HRSD |

| 16 | Aquia Wastewater Treatment Facility | Stafford | 10.0 | ~100,000 | Stafford County |

| 17 | H.L. Mooney Advanced Water Reclamation Facility | Woodbridge | 24.0 | ~300,000 | Prince William County Service Authority |

| 18 | Lynchburg Regional WWTP | Lynchburg | 22.0 | ~80,000 | Lynchburg Water Resources |

| 19 | James River Treatment Plant | Newport News | 20.0 | Regional | HRSD |

| 20 | Falling Creek WWTP | Chesterfield | 12.0 | ~100,000 | Chesterfield County Utilities |

Detailed Profiles of the Top 5 Largest Facilities

1. Noman M. Cole, Jr. Pollution Control Plant

- Location: Lorton, Fairfax County, VA

- Design Capacity: 67 MGD

- Current Average Flow: 42 MGD

- Operating Authority: Fairfax County Wastewater Management

- Receiving Water: Pohick Creek (Potomac River tributary)

Treatment Process: The Noman M. Cole plant utilizes advanced tertiary treatment. Processes include preliminary screening, primary clarification, activated sludge with biological nutrient removal (BNR), tertiary filtration (multimedia filters), and UV disinfection. It is one of the pillars of Chesapeake Bay protection in Northern Virginia.

Infrastructure & Innovation: The facility recently completed moving bed biofilm reactor (MBBR) pilots to enhance nitrogen removal efficiency. It employs anaerobic digestion for solids, with biogas utilized for on-site heating.

Compliance: Consistently achieves platinum-level compliance for NACWA Peak Performance awards. The plant operates under strict limits for Nitrogen (3 mg/L) and Phosphorus (0.18 mg/L).

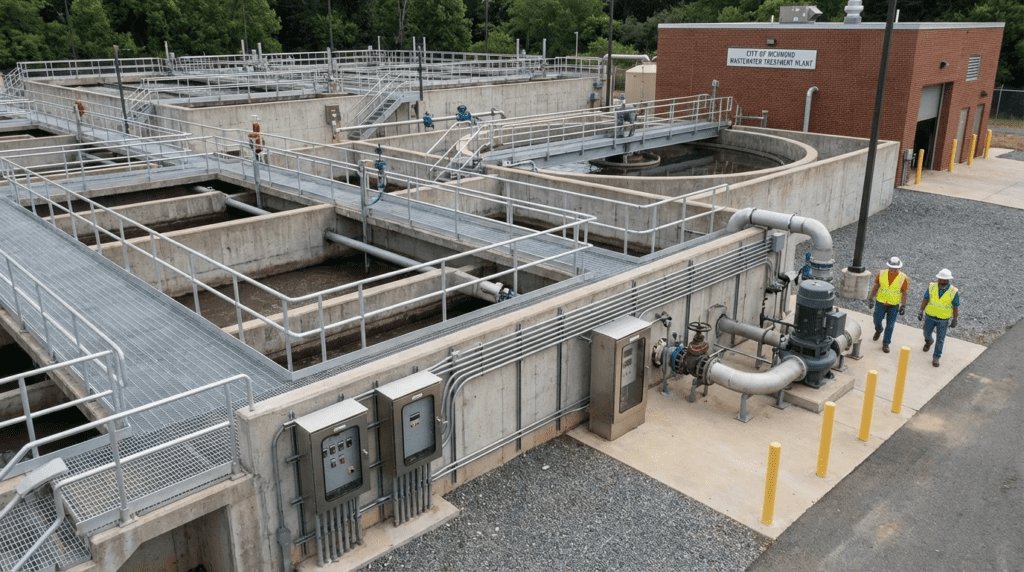

2. Richmond Wastewater Treatment Plant (R. Byrd)

- Location: Richmond, VA

- Design Capacity: 45 MGD (Dry), 70 MGD (Wet Weather)

- Operating Authority: City of Richmond Department of Public Utilities

- Receiving Water: James River

Treatment Process: As a Combined Sewer System (CSS) facility, this plant is designed to handle massive hydraulic swings. It utilizes screening, grit removal, primary sedimentation, activated sludge for secondary treatment, and chlorination/dechlorination.

Notable Projects: The facility is the centerpiece of the “Clean River Project,” a massive initiative to reduce CSO events. The plant is currently undergoing upgrades to increase wet weather treatment capacity to reduce untreated overflows into the James River.

3. Upper Occoquan Service Authority (UOSA)

- Location: Centreville, VA

- Design Capacity: 54 MGD

- Operating Authority: UOSA (Joint Authority)

- Receiving Water: Occoquan Reservoir (Indirect Potable Reuse)

Treatment Process: UOSA is a world-renowned advanced water reclamation facility. It was one of the first major plants in the U.S. designed for indirect potable reuse. The process includes chemical clarification, two-stage recarbonation, multimedia filtration, Granular Activated Carbon (GAC) adsorption, and ion exchange for ammonium removal.

Infrastructure: The plant acts as a drought buffer for the Occoquan Reservoir, providing a significant portion of the drinking water supply volume during dry months.

4. AlexRenew Water Resource Recovery Facility

- Location: Alexandria, VA

- Design Capacity: 54 MGD

- Operating Authority: Alexandria Renew Enterprises

- Receiving Water: Hunting Creek (Potomac River)

Treatment Process: AlexRenew utilizes preliminary treatment, primary settling, and a biological nutrient removal system utilizing a distinct anammox bacteria sidestream treatment to reduce nitrogen efficiently. Disinfection is achieved via UV irradiation/pasteurization.

Recent Upgrades: The facility is currently integrating the massive RiverRenew tunnel system (see “Major Projects” below) to capture combined sewage and treat it before discharge.

5. HRSD Nansemond Treatment Plant

- Location: Suffolk, VA

- Design Capacity: 30 MGD

- Operating Authority: Hampton Roads Sanitation District (HRSD)

- Receiving Water: James River / Potomac Aquifer (via SWIFT)

Treatment Process: Nansemond is the pilot and primary site for the SWIFT Research Center. It utilizes a 5-step BNR process followed by the advanced SWIFT train: flocculation, ozonation, biologically active filtration (BAF), and granular activated carbon (GAC) before aquifer recharge.

Regional Facility Summaries

HRSD Virginia Initiative Plant (Rank 6): A 40 MGD facility in Norfolk utilizing a specific BNR configuration (the VIP process) developed by HRSD, serving as a model for biological phosphorus removal globally.

Arlington WPCP (Rank 7): Located in a dense urban footprint near the Pentagon, this 40 MGD plant has undergone extensive retrofitting to achieve state-of-the-art nutrient limits within a confined site.

Roanoke Regional (Rank 12): A 55 MGD (peak) facility serving the Blue Ridge region, critical for protecting the water quality of the Roanoke River and Smith Mountain Lake.

Plants with Approved Budgets & Expansion Projects

A. Major Projects Under Construction (2024-2026)

AlexRenew: RiverRenew Tunnel System

- Location: Alexandria, VA

- Project Scope: Construction of a 2-mile waterfront tunnel, diversion facilities, and pumping stations to mitigate CSOs.

- Total Budget: $615 Million

- Funding: WIFIA Loan ($321M), VPRA grants, Revenue Bonds.

- Timeline: Tunnel mining completed 2024; System online by July 2025.

- Key Contractors: Traylor-Shea (Design-Build).

- Drivers: State legislation requiring remediation of 4 major CSO outfalls by July 1, 2025.

HRSD: SWIFT (Sustainable Water Initiative for Tomorrow) – Full Scale

- Location: Multiple Sites (Nansemond, James River, etc.)

- Project Scope: Adding advanced water treatment facilities (AWT) to existing WWTPs to treat effluent to drinking water standards for aquifer injection.

- Total Budget: Est. $1.0 – $1.2 Billion (Program wide)

- Funding: EPA WIFIA Loans (multiple tranches), Clean Water SRF.

- Timeline: Ongoing through 2030.

- Technology: Ozone-BAF-GAC-UV.

- Drivers: Aquifer replenishment, subsidence prevention, nutrient credit generation.

Richmond: Interim Nutrient Reduction & CSO Control

- Location: Richmond, VA

- Project Scope: Upgrades to the R. Byrd plant to handle higher wet weather flows and reduce nutrient loads.

- Total Budget: Part of a larger $850M CSO plan.

- Funding: State appropriations ($100M+), SRF, Revenue Bonds.

- Timeline: Phased construction through 2035 (legislative deadline).

B. Projects in Design/Planning Phase (2025-2027)

- Loudoun Water – Broad Run WRF Phase 3 Expansion:

- Est. Budget: $150M+

- Scope: Capacity expansion to accommodate rapid data center and residential growth in Ashburn.

- Status: Planning/Design.

- Western Virginia Water Authority – Roanoke Biogas Upgrades:

- Est. Budget: $25M

- Scope: Enhancement of anaerobic digesters to produce renewable natural gas (RNG).

- Status: Engineering design.

Summary Statistics

- Total Active Capital Investment: >$2.4 Billion active in Virginia.

- Primary Project Drivers:

1. CSO Compliance (Richmond/Alexandria),

2. Water Reuse (HRSD),

3. Capacity for Growth (Loudoun/Stafford). - Funding Source Breakdown: Strong reliance on WIFIA loans for mega-projects, supplemented by Virginia Clean Water Revolving Loan Fund (VCWRLF).

Regulatory & Compliance Landscape

Virginia’s regulatory environment is among the most sophisticated in the nation regarding nutrient management. The Chesapeake Bay TMDL (Total Maximum Daily Load) dictates strict waste load allocations for Nitrogen and Phosphorus. Many facilities operate under the Virginia Nutrient Credit Exchange Association, a market-based program that allows facilities to trade nutrient credits to maintain compliance efficiently.

Emerging Contaminants: VADEQ is currently monitoring PFAS (Per- and Polyfluoroalkyl Substances) across 40+ major wastewater plants. While strict effluent limits are not yet universal, many facilities (especially those with reuse permits like UOSA and HRSD) are preemptively evaluating removal technologies such as GAC and Ion Exchange.

Infrastructure Challenges & Opportunities

Workforce Development: Like many states, Virginia faces a “Silver Tsunami” of retiring Class I operators. This creates opportunities for automated SCADA solutions and third-party operations services.

Climate Resilience: The Hampton Roads region is ground zero for sea-level rise. WWTPs in Norfolk, Virginia Beach, and Newport News are investing heavily in floodwalls, elevated electrical substations, and pumping capacity to handle tidal inundation.

Data Center Growth: Northern Virginia (Data Center Alley) requires massive amounts of cooling water. This presents a lucrative market for reclaimed water systems (purple pipe) provided by utilities like Loudoun Water and UOSA.

Technology Trends in Virginia

Virginia is a testbed for advanced technologies due to the Chesapeake Bay requirements:

- Nutrient Removal: Widespread use of 5-Stage Bardenpho, MLE, and IFAS (Integrated Fixed-Film Activated Sludge).

- Advanced Oxidation: High adoption of UV and Ozone, particularly in SWIFT projects.

- Energy Neutrality: Increasing installation of Combined Heat and Power (CHP) systems using digester gas (e.g., AlexRenew, Fairfax County).

- Trenchless Tech: Extensive use of tunnel boring machines (TBM) for conveyance projects in dense urban corridors like Alexandria.

Resources for Engineers & Operators

- Virginia Water Environment Association (VWEA) – Primary industry group for networking and conferences (WaterJAM).

- Virginia DEQ Water Division – Permitting and compliance data.

- Virginia Water and Waste Authorities Association – Utility management resources.

- Virginia Clean Water Revolving Loan Fund – Funding information.

FAQ

- What is the largest wastewater treatment plant in Virginia?

- The Noman M. Cole, Jr. Pollution Control Plant in Fairfax County is the largest by design capacity located physically within Virginia, at 67 MGD.

- What is the HRSD SWIFT program?

- SWIFT (Sustainable Water Initiative for Tomorrow) is an innovative water reuse program by HRSD to treat wastewater to drinking water standards and recharge the Potomac Aquifer to prevent land subsidence.

- Are there CSO communities in Virginia?

- Yes, primarily Richmond, Lynchburg, and Alexandria. All are currently under strict state legislative mandates to remediate their combined sewer overflows by specific deadlines (2025-2035).

- What nutrient limits do Virginia plants face?

- Limits vary by watershed, but major plants often face Total Nitrogen limits of 3.0-4.0 mg/L and Total Phosphorus limits of 0.18-0.30 mg/L to protect the Chesapeake Bay.

- How much is Virginia investing in wastewater infrastructure?

- Current active major capital projects exceed $2.4 billion, largely driven by the RiverRenew project ($615M), Richmond CSO work ($800M+ long term), and the HRSD SWIFT program ($1B+).