New York Wastewater Treatment Plants

Table of Contents

- Introduction to NY Wastewater Infrastructure

- Recent Developments & Market Overview

- Top 20 Largest Treatment Plants

- Approved Budgets & Expansion Projects

- Regulatory & Compliance Landscape

- Infrastructure Challenges

- Technology Trends

- Resources for Engineers

- Frequently Asked Questions

1. Introduction

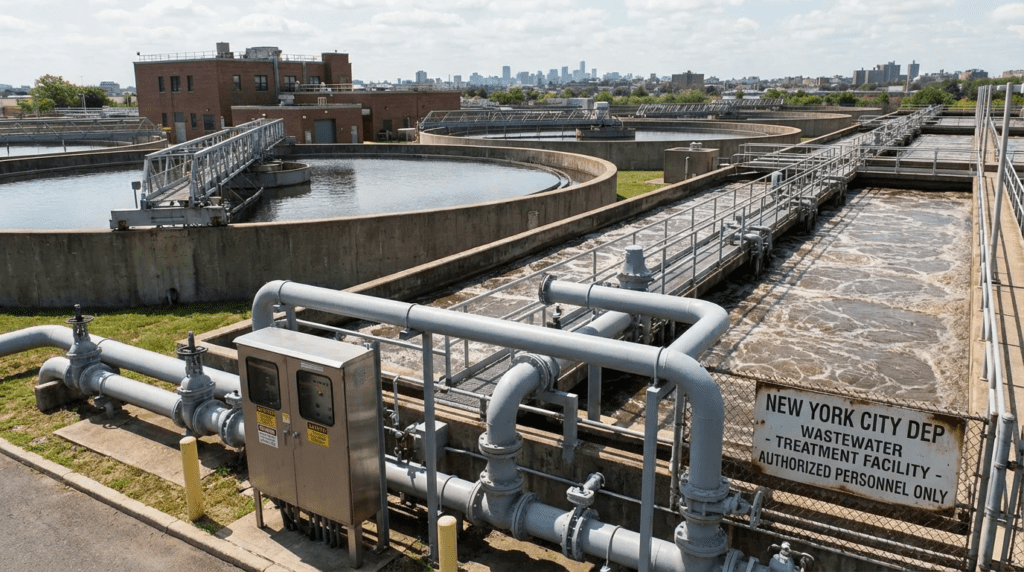

New York State represents one of the most complex and robust wastewater markets in the United States, characterized by the massive scale of the New York City Department of Environmental Protection (NYC DEP) system and the diverse needs of upstate municipalities protecting the Great Lakes and Hudson River watersheds. The state manages over 600 wastewater treatment facilities serving a population of nearly 19 million people.

The state’s infrastructure is a study in contrasts: from the 14 massive plants in NYC treating 1.3 billion gallons daily, to smaller advanced treatment facilities in the sensitive Adirondack Park. Currently, New York is in a cycle of aggressive capital reinvestment, driven by the Clean Water Infrastructure Act of 2017 and subsequent appropriations. The primary engineering challenges facing the state include Combined Sewer Overflow (CSO) abatement, nitrogen reduction in the Long Island Sound and Peconic Estuary, and critical resiliency upgrades following Superstorm Sandy and recent localized flooding events.

For consulting engineers and equipment vendors, New York offers a stable pipeline of projects funded by the NYS Environmental Facilities Corporation (EFC), which manages the largest State Revolving Fund (SRF) in the nation.

2. Recent Developments & Projects

In the last 36 months, New York has accelerated its transition from basic secondary treatment compliance to advanced resource recovery and resiliency. A dominant theme is the Long Island Nitrogen Action Plan (LINAP), which is driving billions of dollars in investment to sewer unsewered areas in Suffolk County and upgrade existing plants in Nassau County to tertiary treatment standards.

The NYC DEP continues its multi-billion dollar commitment to reducing CSOs through “Grey” and “Green” infrastructure. The department has also launched major energy neutrality initiatives, seeking to make its wastewater resource recovery facilities (WRRFs) energy neutral by 2050 through enhanced anaerobic digestion and co-generation. Upstate, the focus remains on aging infrastructure replacement; the “Clean Watersheds Needs Survey” consistently ranks New York among the highest in the nation for documented wastewater infrastructure needs, exceeding $30 billion.

Notable Trends:

- Resiliency: Post-Sandy hardening of electrical switchgear and pumps at coastal plants is transitioning from planning to construction.

- Design-Build: New York has increasingly utilized design-build procurement for major infrastructure, such as the Bay Park Conveyance Project, accelerating project delivery.

- Emerging Contaminants: Strict state regulations on 1,4-Dioxane and PFOA/PFOS are triggering new pilot studies and technology retrofits statewide.

3. Top 20 Largest Treatment Plants in New York

The following list ranks New York’s wastewater treatment facilities by Design Capacity (MGD). While NYC DEP facilities dominate the top tier, significant regional authorities in Buffalo, Rochester, and Long Island operate major infrastructure critical to the state’s environmental health.

| Rank | Plant Name | City/Location | Design Capacity (MGD) | Population Served | Operating Authority |

|---|---|---|---|---|---|

| 1 | Newtown Creek WRRF | Brooklyn (Greenpoint) | 310 MGD | 1.3 million | NYC DEP |

| 2 | Wards Island WRRF | New York (Manhattan) | 275 MGD | 1.0 million | NYC DEP |

| 3 | Hunts Point WRRF | Bronx | 200 MGD | 700,000 | NYC DEP |

| 4 | Bird Island WWTP | Buffalo | 180 MGD | 550,000 | Buffalo Sewer Authority |

| 5 | North River WRRF | New York (Manhattan) | 170 MGD | 600,000 | NYC DEP |

| 6 | Frank E. Van Lare WRRF | Rochester | 135 MGD | 675,000 | Monroe County DES |

| 7 | Owls Head WRRF | Brooklyn | 120 MGD | 750,000 | NYC DEP |

| 8 | 26th Ward WRRF | Brooklyn | 85 MGD | 280,000 | NYC DEP |

| 9 | Coney Island WRRF | Brooklyn | 110 MGD | 600,000 | NYC DEP |

| 10 | Bowery Bay WRRF | Queens | 150 MGD | 850,000 | NYC DEP |

| 11 | Tallman Island WRRF | Queens | 80 MGD | 400,000 | NYC DEP |

| 12 | Jamaica WRRF | Queens | 100 MGD | 700,000 | NYC DEP |

| 13 | Syracuse Metro WWTP | Syracuse | 84 MGD | 270,000 | Onondaga County WEP |

| 14 | Bay Park STP | East Rockaway | 70 MGD | 550,000 | Nassau County / Suez |

| 15 | Cedar Creek WPCP | Wantagh | 72 MGD | 600,000 | Nassau County / Suez |

| 16 | Rockaway WRRF | Queens | 45 MGD | 90,000 | NYC DEP |

| 17 | Oakwood Beach WRRF | Staten Island | 40 MGD | 250,000 | NYC DEP |

| 18 | Albany County South Plant | Albany | 35 MGD | 150,000 | Albany County Water Purification |

| 19 | Binghamton-Johnson City | Vestal | 35 MGD | 110,000 | BJC Joint Sewage Board |

| 20 | Southwest Sewer District | West Babylon | 30 MGD | 340,000 | Suffolk County DPW |

Detailed Profiles of the Top 5 Largest Plants

1. Newtown Creek WRRF (NYC DEP)

- Location: Greenpoint, Brooklyn, NY

- Design Capacity: 310 MGD (Peak wet weather: 700 MGD)

- Population Served: ~1.3 million (Manhattan, Brooklyn, Queens)

- Operating Authority: NYC Department of Environmental Protection

- Receiving Water: East River / Newtown Creek

Treatment Process: Newtown Creek is NYC’s largest plant and features the iconic “Digester Eggs” visible from the LIE. The plant utilizes modified aeration activated sludge. It does not have primary settling tanks in the traditional sense due to space constraints; it uses high-rate grit removal and screening.

Recent Upgrades: The facility recently underwent a massive $5 billion upgrade to meet Clean Water Act standards. Current initiatives include a partnership with National Grid to purify digester gas into Renewable Natural Gas (RNG) for the local grid, one of the first projects of its scale in the country.

2. Wards Island WRRF (NYC DEP)

- Location: Wards Island, New York, NY

- Design Capacity: 275 MGD

- Population Served: ~1.0 million (Bronx and Upper Manhattan)

- Operating Authority: NYC DEP

Infrastructure: As the second-oldest plant in the city (1937), Wards Island has been the focus of extensive Biological Nutrient Removal (BNR) upgrades to reduce nitrogen loading into the East River/Long Island Sound. The facility utilizes step-feed activated sludge and large-scale centrifugal dewatering.

Notable Features: The plant includes a massive solids handling facility that processes sludge from other city plants via marine vessel transfer.

3. Hunts Point WRRF (NYC DEP)

- Location: Bronx, NY

- Design Capacity: 200 MGD

- Population Served: ~700,000

- Operating Authority: NYC DEP

Compliance & Performance: Hunts Point has been central to nitrogen reduction efforts for the Long Island Sound. Recent retrofits include the installation of polymer addition systems and centrate treatment facilities to manage nitrogen-rich side streams.

4. Bird Island WWTP (Buffalo Sewer Authority)

- Location: Buffalo, NY (Erie County)

- Design Capacity: 180 MGD (Peak Hydraulic Capacity: 570 MGD)

- Population Served: ~550,000

- Receiving Water: Niagara River

Treatment Process: Situated between the Niagara River and the Black Rock Canal, Bird Island is a critical protector of the Great Lakes. It utilizes pure oxygen activated sludge (UNOX). The plant is designed to handle massive wet-weather flows due to Buffalo’s combined sewer system.

Recent Upgrades: A major “Smart Sewer” initiative utilizing real-time control (RTC) sensors throughout the collection system has significantly reduced CSO events without requiring massive grey infrastructure expansion.

5. North River WRRF (NYC DEP)

- Location: West Harlem, Manhattan, NY

- Design Capacity: 170 MGD

- Population Served: ~600,000

Infrastructure: Famous for being constructed on a massive caisson platform over the Hudson River, with the 28-acre Riverbank State Park built on its roof. It provides secondary treatment via step-feed aeration.

Odor Control: Due to the public park on its roof, North River has one of the most sophisticated odor control systems in the world, utilizing massive carbon scrubbers and chemical misting towers.

4. Plants with Approved Budgets & Expansion Projects

- Total Active Capital Investment: ~$3.8 Billion (Major Projects)

- Primary Funding Source: NYS Clean Water State Revolving Fund (CWSRF) & WIFIA

- Key Driver: Nitrogen Reduction (Long Island) and CSO Abatement (NYC/Upstate)

A. Major Projects Under Construction (2024-2026)

Bay Park Conveyance Project – $539 Million

- Location: Nassau County, NY

- Facilities Involved: Bay Park STP, Cedar Creek WPCP

- Scope: Construction of a new pump station and repurposing of an aqueduct to convey treated effluent from the Bay Park plant to the Cedar Creek ocean outfall. This diverts nitrogen-rich discharge away from the sensitive Western Bays marshlands.

- Contractor/Delivery: Design-Build team “Western Bays Constructors” (John P. Picone / Northeast Remsco).

- Technology: Microtunneling, sliplining, and advanced pumping systems.

- Status: Active construction, anticipated completion 2024/2025.

Newtown Creek WRRF Power Resiliency – $140 Million+

- Location: Brooklyn, NY

- Scope: Replacement of main electrical substations and emergency generation capabilities to ensure continuous operation during grid failures or storm surges (post-Sandy hardening).

- Funding: NYC DEP Capital Funds, FEMA.

- Status: Construction ongoing.

Suffolk County Coastal Resiliency & Nitrogen Expansion – $200 Million+

- Location: Suffolk County (Bergen Point WWTP)

- Scope: Replacement of Outfall 001. The Bergen Point plant is the largest in Suffolk County. The project replaces the aging outfall pipe to ensure reliable discharge into the Atlantic Ocean.

- Engineering: CDM Smith / GHD.

- Status: Deep tunneling phases active.

B. Projects in Design/Planning Phase (2025-2027)

- Syracuse Metro WWTP Digester Upgrades ($60M+): Onondaga County is planning comprehensive upgrades to the anaerobic digestion complex to improve biosolid quality and increase energy recovery.

- Cheektowaga/Erie County Consolidation: Ongoing planning to consolidate smaller aging plants into the larger Buffalo/Erie County regional systems to improve efficiency and compliance.

- NYC DEP Cloudburst Management ($400M committed): While not a single plant upgrade, this massive distributed infrastructure program aims to manage stormwater before it hits the combined sewer system, directly impacting plant peak loading at Wards Island and Newtown Creek.

C. Future Projects with Committed Funding

- Suffolk County Sewer Expansion (Forge River/Carlls River): Funded largely by post-Sandy resiliency grants, these projects involve connecting thousands of homes currently on septic systems to new or expanded treatment plants to reduce groundwater nitrogen pollution.

5. Regulatory & Compliance Landscape

Engineering decisions in New York are heavily influenced by the New York State Department of Environmental Conservation (NYSDEC). New York is an authorized state for NPDES permitting (termed SPDES in NY).

Critical Regulatory Drivers:

- Long Island Nitrogen Action Plan (LINAP): A multi-year initiative to reduce nitrogen loading to Long Island Sound and the Peconic Estuary. This is the primary driver for advanced treatment upgrades (BNR) in Nassau and Suffolk counties.

- CSO Long Term Control Plans (LTCP): NYC DEP and upstate cities (Buffalo, Albany, Syracuse) operate under consent decrees requiring significant reduction of Combined Sewer Overflows. This drives investment in High-Rate Disinfection and massive retention tunnels.

- 1,4-Dioxane Limits: New York has established some of the strictest limits in the nation for 1,4-Dioxane (1 ppb for drinking water), which is impacting discharge permits and requiring Advanced Oxidation Processes (AOP) evaluations.

6. Infrastructure Challenges & Opportunities

Aging Workforce & Automation

Like many states, New York faces a “Silver Tsunami” of retiring Grade 4 operators. This is creating immediate opportunities for engineering firms to implement SCADA upgrades and automation technologies to allow for leaner staffing models.

Climate Resiliency

Following Superstorm Sandy and Hurricane Ida, “Hardening” is a line item in almost every coastal plant budget. This includes raising critical equipment above the 500-year flood plain, installing submarine doors, and building perimeter floodwalls.

Biosolids Disposal

With landfill space in the Northeast becoming scarce and expensive, New York utilities are aggressively exploring Thermal Drying and Pyrolysis to reduce sludge volume and create Class A biosolids for beneficial reuse.

7. Technology Trends in New York

- Co-Digestion & RNG: NYC DEP is leading the way in accepting food waste slurry to co-digest with sludge, significantly boosting biogas production for pipeline injection.

- Peracetic Acid (PAA) Disinfection: Several upstate plants are converting from Chlorine gas or Hypochlorite to PAA for disinfection to eliminate the formation of chlorinated byproducts and reduce toxicity to aquatic life.

- Membrane Bioreactors (MBR): Being adopted in decentralized systems and smaller community plants (e.g., in the Catskills/Watershed areas) where footprint is limited and effluent quality requirements are extremely high.

9. Resources for Engineers & Operators

- NYWEA (New York Water Environment Association): The state chapter of WEF, hosting the annual meeting in NYC which is the largest regional water conference in the Northeast.

- NYS Environmental Facilities Corporation (EFC): The financing authority managing the SRF. Essential for understanding funding cycles for municipal projects.

- NYSDEC Division of Water: Source for SPDES permit data, technical guidance, and design standards (Ten States Standards).

10. Frequently Asked Questions

What is the largest wastewater treatment plant in New York?

The Newtown Creek Wastewater Resource Recovery Facility in Brooklyn is the largest, with a design capacity of 310 MGD and the ability to handle up to 700 MGD during wet weather.

What funding is available for WWTP upgrades in New York?

The primary source is the Clean Water State Revolving Fund (CWSRF), managed by the NYS EFC. Additionally, the state provides grants through the Water Infrastructure Improvement Act (WIIA) and Intermunicipal Grants (IMG).

Which engineering firms are active in New York wastewater?

Major global firms including Hazen and Sawyer, AECOM, Arcadis, CDM Smith, Jacobs, and Carollo are highly active, alongside strong regional firms like H2M architects + engineers and Barton & Loguidice.

How many wastewater treatment plants are in NYC?

The NYC DEP operates 14 wastewater resource recovery facilities located across the five boroughs.

What is the Bay Park Conveyance Project?

It is a $539 million partnership between Nassau County and NY State to convey treated water from the Bay Park plant to the Cedar Creek ocean outfall, removing nitrogen loading from the Western Bays.